Energy and Basic Resources - Transaction Multiples

Epsilon Research covers the M&A transactions for the "Energy and Basic Resources" industry [169 EMAT Reports], which includes:

NB: excludes "Renewable Energy", which is classified under the "Environment & Climate Change" sector

Our analysts publish transaction multiples reports for private company M&A deals (announced 2004 onwards).

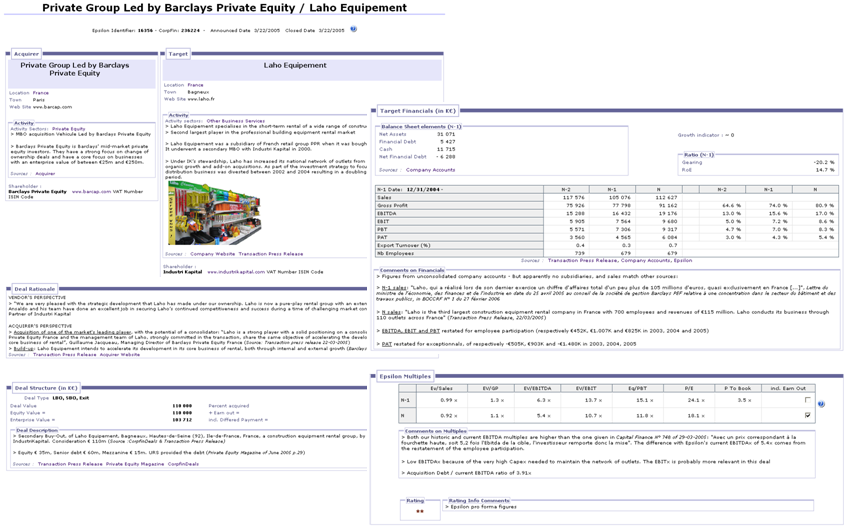

Each report presents detailed information on the deal value, structure and rationale, the target's activity, history and financial information; it includes the calculation of the key historic and current multiples: enterprise value over sales (EV/S), EBITDA (EV/EBITDA), or EBIT (EV/EBIT), P/E and Price to Book. All information sources are systematically given and company financials are carefully verified and restated if needed.

The reports are a unique source of information to have a comparable metric for the valuation of a private company, establish the "market value" of an investment or private equity investment portfolios.

The deal reports are published in Epsilon's EMAT database.

For an example of EMAT report, please click on this link.

If you wish to buy an EMAT Report, and you are not a customer, please contact us.

Recent M&A Deal Reports Published on EMAT

| Date | Acquirer | Target | Country | Industries | Valuation multiples | See details |

|---|---|---|---|---|---|---|

| 14/11/2023 | DCC | PROGAS | Germany | Utilities | ** | 115238 |

| 03/10/2023 | RHI Magnesita | Preiss-Daimler Group refractory business (P-D Refractories) | Germany | Mining | * | 114722 |

| 25/02/2022 | Mint Energie | Planete Oui Assets | France | Utilities | *** | 116104 |

| 21/02/2022 | TAQA | Tendeka | Netherlands | Oil & Gas, Electronic Equipment | * | 109585 |

| 28/01/2022 | Octopus Energy Group | Plum Energie | Seine-Saint-Denis | Utilities | * | 116056 |

| 26/04/2021 | Archer | DeepWell | Norway | Oil & Gas | *** | 109537 |

| 10/03/2021 | Frank's International | Expro International Group (Legacy Expro) | Cayman Islands | Oil & Gas, Engineering and Technology Consulting | *** | 109608 |

| 26/10/2020 | Private Group Led By Allianz Capital Partners | Galp Gas Natural Distribuicao | Portugal | Utilities | *** | 103281 |

| 29/09/2020 | TotalEnergies | Source London Mobility Solutions (Blue Point London) | England | Utilities, Clean Tech | *** | 112867 |

| 13/02/2020 | Electricite de France | Pod Point | United Kingdom | Utilities, Clean Tech | *** | 112855 |

| 12/02/2020 | Compañía Minera Autlán, SAB de CV | Cegasa Portable Energy (Cegasa EMD) | Spain | Utilities, Specialty Chemicals, CleanTech - Power Storage | * | 98760 |

| 08/01/2020 | Anglo American | Sirius Minerals (now Anglo American Woodsmith) | United Kingdom | Mining | ** | 113411 |

| 04/07/2019 | Peab | Nordic Paving and Mineral Aggregates Business of YIT | Finland | Building Materials & Fixtures, Mining | *** | 95807 |

| 15/04/2019 | Savannah Resources | Savannah Lithium Lda | Portugal | Mining | ** | 94573 |

| 28/11/2018 | Private Group Led By European Diversified Infrastructure Fund II | OÜ Utilitas | Estonia | Utilities, Renewable Energy | * | 102604 |

| 09/11/2018 | Alperia | Services Unindustria Multiutilities | Italy | Financial Services, Utilities | ** | 96638 |

| 20/09/2018 | Total | Direct Energie | France | Oil & Gas, Utilities, Wind Producer / Generator, Solar Producer / Generator, Hydroelectricity | *** | 96796 |

| 10/07/2018 | Private Group Led by ProA Capital | Neoelectra Energia | Spain | Utilities, Biomass | * | 104704 |

| 10/04/2018 | Co-operative Energy | Flow Energy | England | Utilities | *** | 96645 |

| 23/03/2018 | Elia System Operator | Eurogrid International (50Hertz Transmission) | Belgium | Utilities | *** | 93583 |